Over 100 Positive & Verified Reviews

Over 100 Positive & Verified Reviews

Explode Your Business Growth With Our Funding Services

In today's complex financial landscape, our expert advisors are here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

What we do

Funding Made Simple,

With You in Mind

As a Business Consultant, our team is held to the highest ethical standards. Your financial interests always come first, and we are dedicated to providing you with unbiased advice that is solely in your best interest. You can trust us to act with integrity and professionalism.

At 800 Approved Wealth Group, we offer full funding services and believe financial support should be simple, transparent, and centered on your goals. With solutions designed for every stage of life, we make funding feel less like a hurdle and more like a step toward stability.

1

Flexible funding options

tailored to your needs

2

Transparent rates with

no hidden surprises

3

Guidance from our experienced team

4

Fast and hassle-free

application process

Focused on funding what matters most — your future.

How Our Funding Process Works

We’ve made the funding process simple, transparent, and stress-free — so you can focus on what matters most.

Step 1

Apply Online

Fill out a quick application with your details and funding preferences — it only takes a few minutes.

Step 2

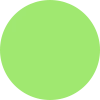

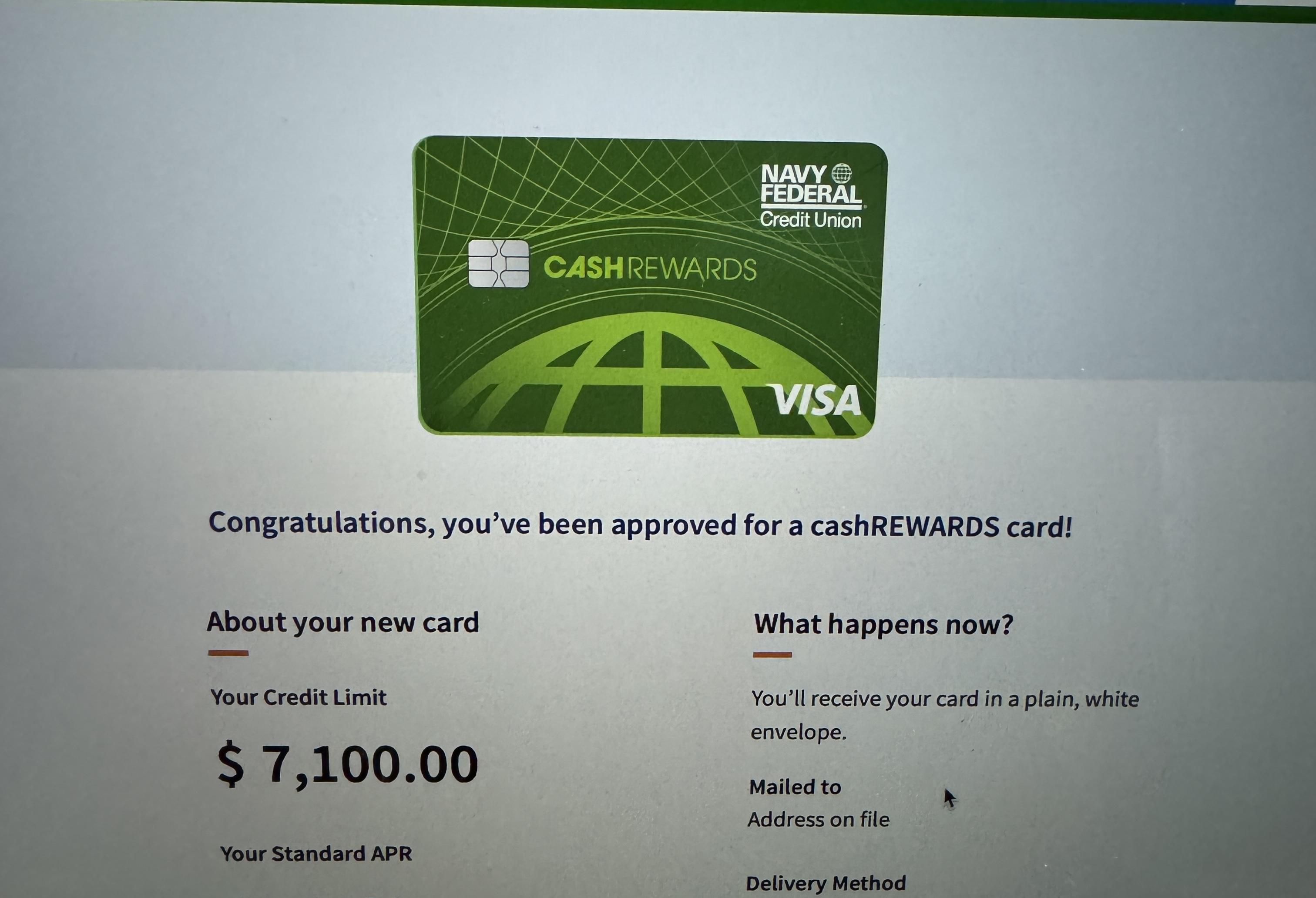

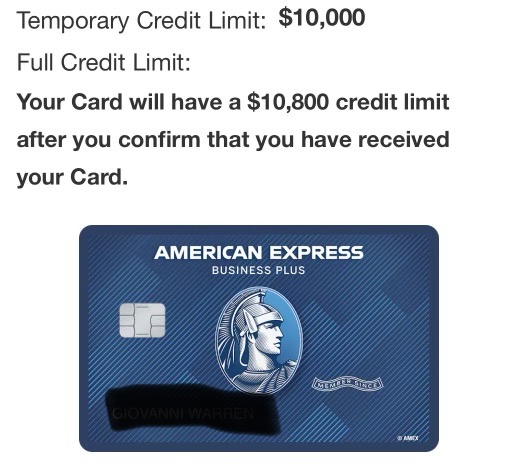

Get Approved

Our team reviews your application promptly and provides clear options tailored to your needs.

Step 3

Receive Your Funds

Once approved, your funds are released quickly so you can move forward with confidence.

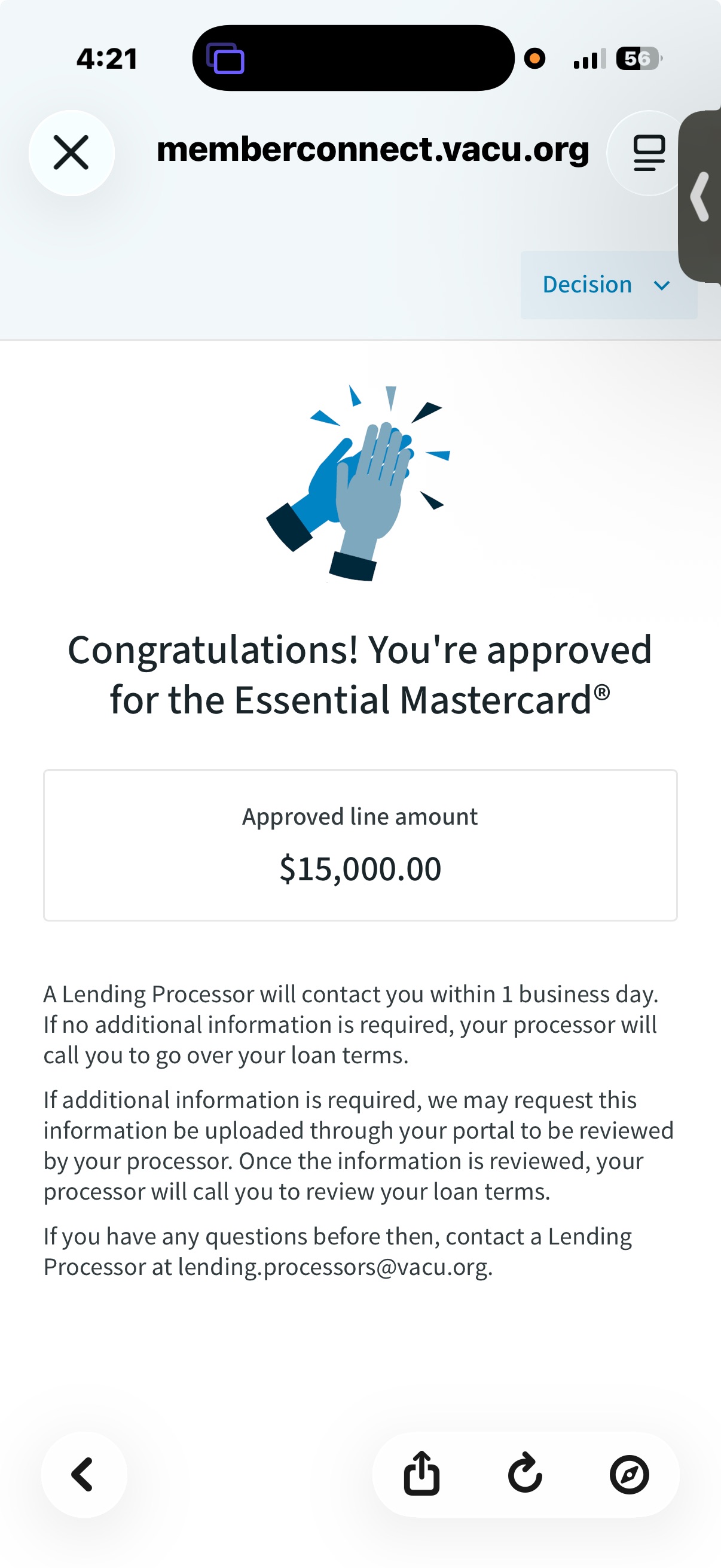

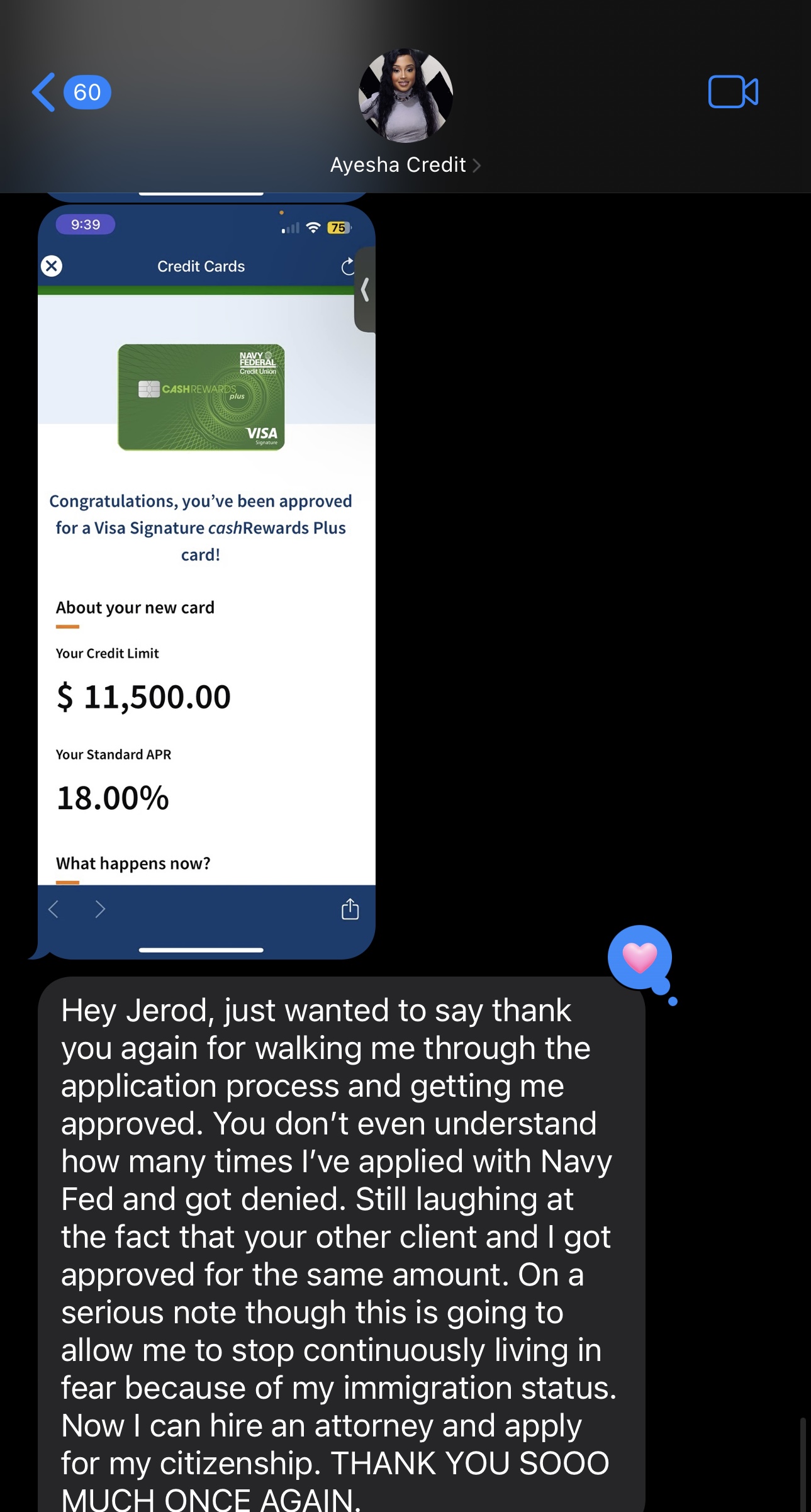

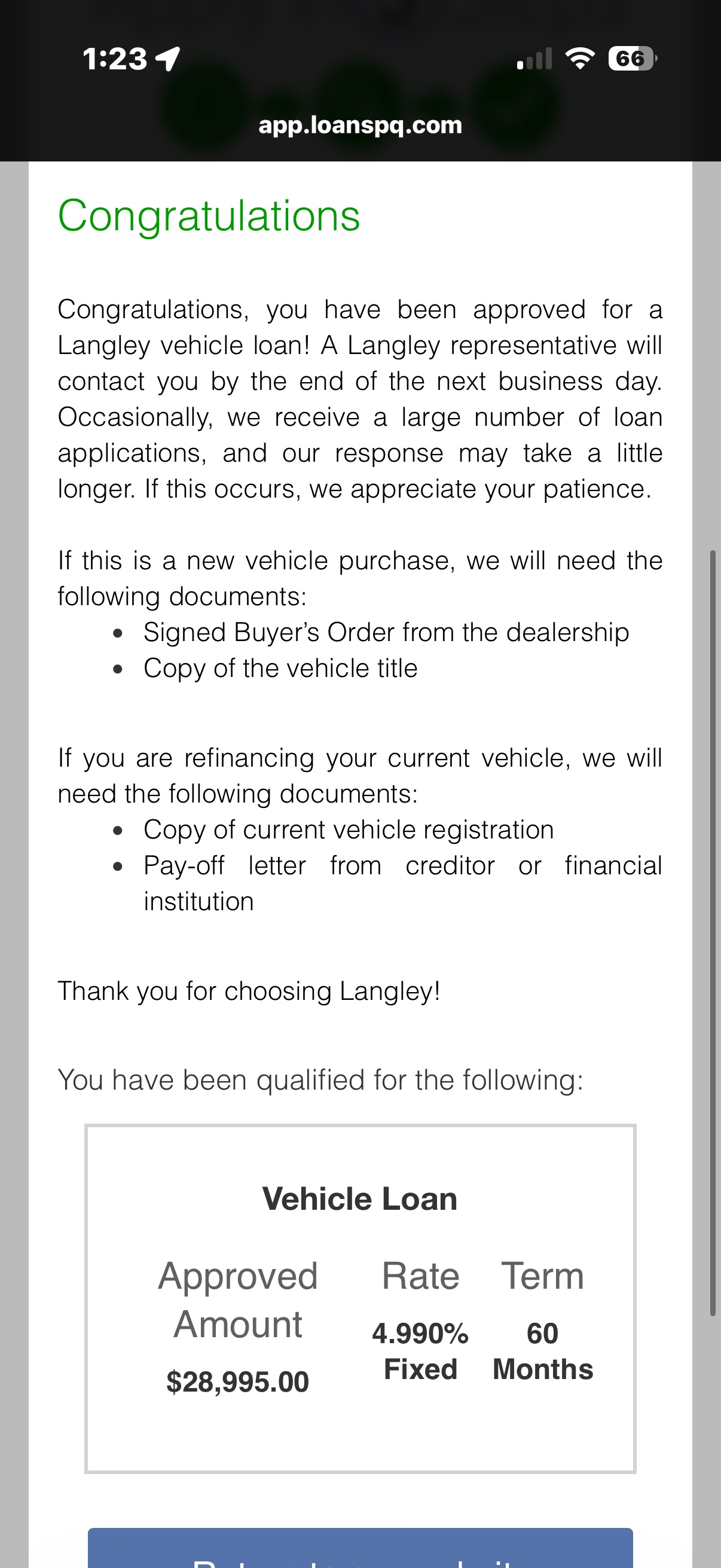

Our Client's Results

Hear From Ayesha

Why Trust Our Expertise?

Experience You Can Count On

For Your Better Future

Happy Customer

Value For Money

Average success rate

We Provide

Around-the-Clock Financial Guidance

At 800Approved we understand that financial questions and concerns will arise. That's why we pride ourselves in teaching our clients the new strategies that work best for them. Whether you have a pressing financial issue in the middle of the night or need guidance during the weekend, our team of expert advisors is here to assist you at any time.

Comprehensive Funding Planning

We aim to keep you informed on the newest funding strategies that will keep you ahead of the industry. We provide custom solutions to ensure you hit your funding goals to ensure you have a good financial runway for success.

No Doc Lines Of Credit

The lack of capital smothers businesses and having No Doc lines of credit allow you to tap into as much capital as you need at that point without being obligated to pay back what you don't need.

Business Funding For Growth

We pride ourselves in finding unique ways to get business owners the funding they need in order to hit their goals.

We realize that in today's economy most banks have strict guidelines thats why we have built strategic relationships to ensure all of our clients secure capital for growth.

The difference between a successful business and those who struggle is the access to resources and capital.

Explode Your Business Growth With Our Funding Services

In today's complex financial landscape, our expert advisors are here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

Good Approach

Great Ideas

Great Ideas

Save Money

Acquire Capital

Detailed Funding

Detailed Funding

Meet Our Team

The people behind 800 Approved Solutions are passionate about helping you succeed.

JOE HOUSTON

Financial Consultant

Joe focuses on budgeting, refinancing, and helping clients restructure funding for stability.

BRANDI RORIE

Client Relations Manager

Emily ensures every client has a smooth, supportive experience from application to approval.